There’s comfort in being around people who share common interests, goals, and challenges. That comfort in a community doesn’t wane with age – it actually deepens. Whether it’s proudly talking about grandchildren or lamenting the fact that our eyes aren’t as good as they used to be, it helps to be around people who not only understand what we’re saying but actually feel the same joys and concerns as well.

That’s why many boomers are deciding to move into an active adult community. In the latest

55places National Housing Survey, they were described by one out of three seniors as an

“outgoing, social community of likeminded people.”

Bill Ness, Chief Executive Officer and Founder of 55places.com, explains:

“Baby boomers are now reaching the age when moving to an active adult community is the ideal opportunity for them…Many boomers now want to downsize, experience a maintenance-free lifestyle, and pursue more social opportunities. It’s exciting that there are so many choices for baby boomers.”

There’s still a desire, however, among many seniors to “

age-in-place.” According to the

Senior Resource Guide, aging-in-place means:

“…that you will be remaining in your own home for the later years of your life; not moving into a smaller home, assisted living, or a retirement community etcetera.”

The challenge is, many seniors live in suburban or rural areas, and that often necessitates driving significant distances to see friends or attend other social engagements. A recent report from the

Joint Center for Housing Studies of Harvard University (JCHS) titled

Housing America’s Older Adults addressed this exact concern:

“The growing concentration of older households in outlying communities presents major challenges for residents and service providers alike. Single-family homes make up most of the housing stock in low-density areas, and residents typically need to be able to drive to do errands, see doctors, and socialize.”

The Kiplinger report also chimed in on this subject:

“While most seniors say they want to age in place, a much smaller percentage of them actually manage to accomplish it, studies show. Transportation is often a problem; when you can no longer drive, you can’t get to medical appointments or to other outings.”

Driving may not be a challenge right now, but think about what it may be like to drive 10, 20, or 30 years down the road.

There are also health challenges brought on by a possible lack of socialization when living at home versus a community of seniors. Sarah J. Stevenson is an author who writes about seniors. In a recent

blog post for

A Place for Mom, she explains:

“Social contacts tend to decrease as we age for reasons such as retirement, the death of friends and family, or lack of mobility.”

Thankfully, research from the same article suggests if you’re spending time with others in a community, thus reducing the impact of loneliness and isolation, there’s less of a risk of developing high blood pressure, obesity, heart disease, a weakened immune system, depression, anxiety, cognitive decline, Alzheimer’s disease, and early death.

Though the familiarity of our current home may bring a feeling of warmth, comfort, and convenience, it’s important to understand that staying there may mean missing out on crucial socialization opportunities. Living with adult children, joining a retirement community, or moving to an assisted living facility can help us continue to be with people we enjoy every day.

Bottom Line

“Aging-in-place” definitely has its advantages, but it could mean getting “stuck-in-place” too. There are many health benefits derived from socialization with a community of people that shares common interests. It’s important to take the need for human interaction into consideration when making a decision about where to spend the later years in life.

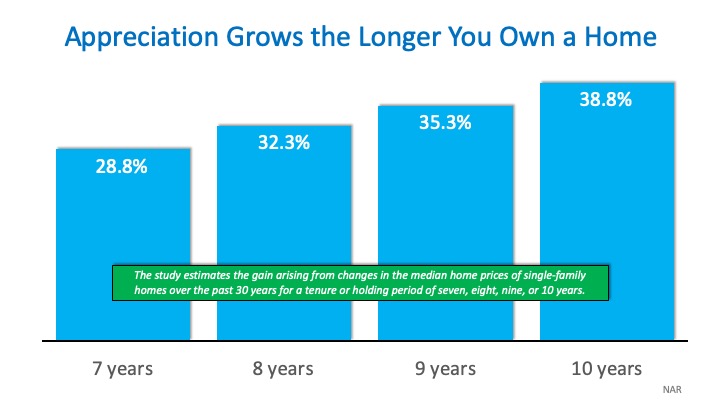

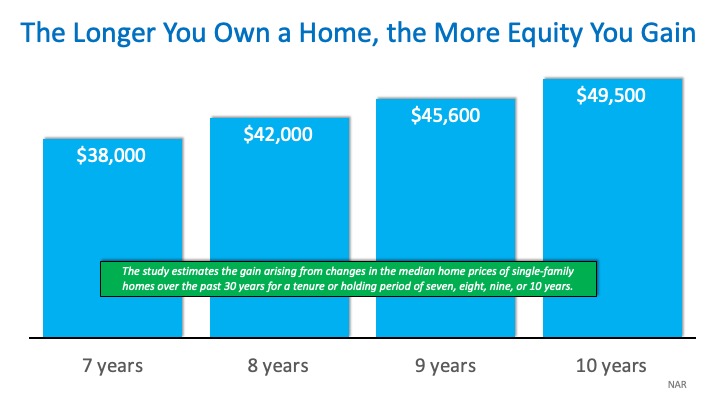

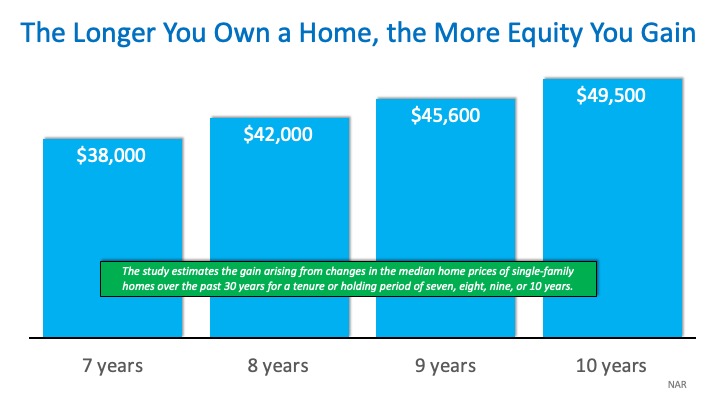

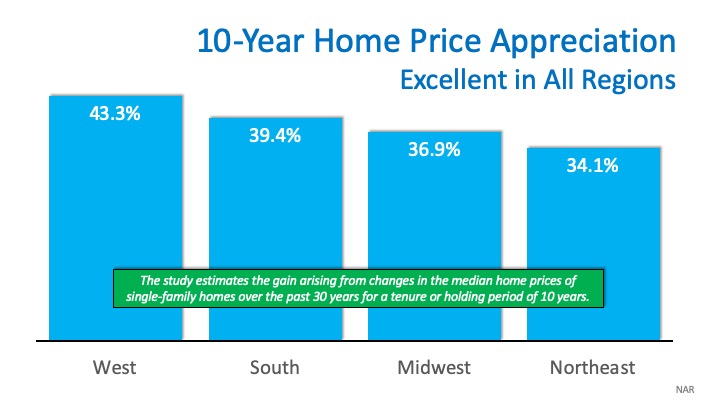

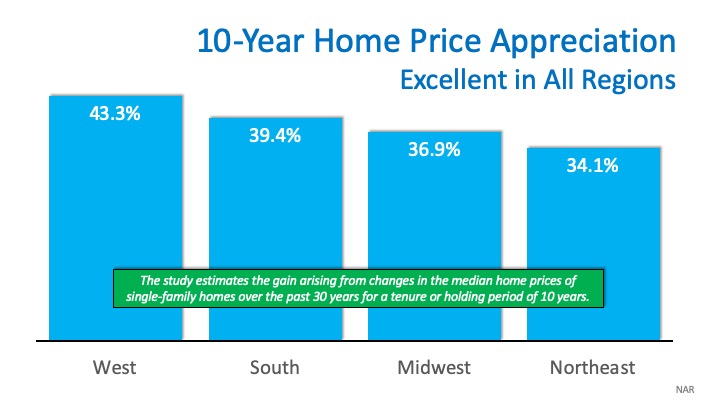

This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence:

This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence: This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence:

This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence: